The 340B program has evolved into a “buy low, sell high” drug pricing system abused by some hospitals that have profits as their main goal, a health policy researcher told lawmakers Wednesday at a U.S. House subcommittee hearing.

The House Ways and Means oversight subcommittee hearing focused on whether nonprofit hospitals are earning their tax-exempt status by providing sufficient benefits to the communities they serve, including charity care. Transparency in and alleged misuse of the 340B program also was discussed.

Witnesses said Congress should better define the community benefits that nonprofit hospitals can provide in order to maintain their tax-exempt status.

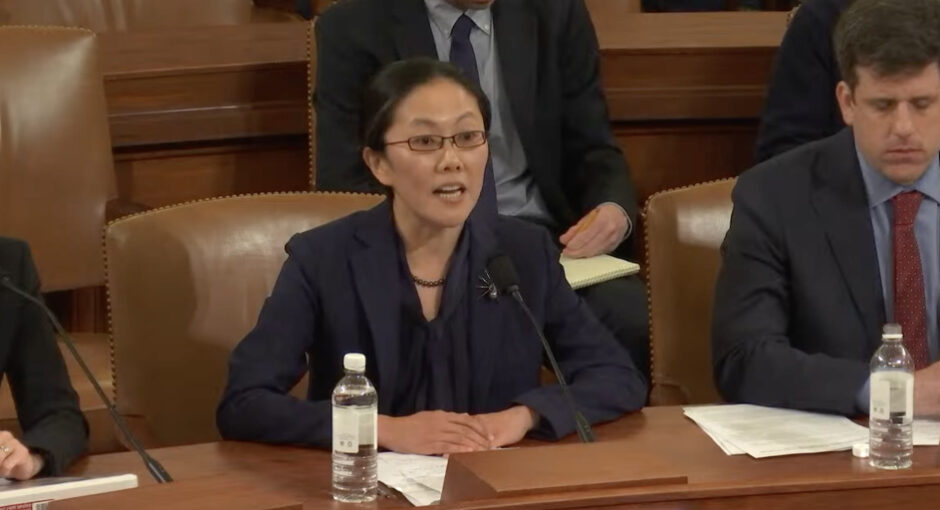

“Right now, there’s no transparency regarding the 340B program,” Ge Bai, professor of accounting and health policy at The Johns Hopkins University, told committee members. “340B was established in 1992 to help hospitals that benefit low-income patients. This was a ‘buy low, sell low’ program at that time. Now it has evolved into a ‘buy low, sell high’ program, because hospitals can sell the discounted drugs to well-insured patients.”

She added, “It also encourages hospital mergers and acquisitions because they can buy physician practices at small hospitals in order to take advantage of the 340B program. These current regulations, including the 340B program, and tax exemption status, are the major reason that we’re seeing more and more acquisitions and small players leaving the market. These are fundamental policy failures, that’s why we’re seeing higher prices and less competition.”

Requiring hospitals to report their gross profits from the 340B program on Schedule H of IRS Form 990 would help address the problem, Bai said. “All of this is easy to estimate, and [would be] no administrative burden whatsoever. That will give taxpayers, stakeholders, and policymakers huge transparency for them to make decisions.”

Hospital groups have argued that new 340B reporting requirement are unnecessary and overly burdensome. They also believe that reporting gross profits is an inaccurate reflection of 340B savings. American Hospital Association Senior Vice President of Public Policy Analysis and Development Ashley Thompson elaborated on the group’s position during a different House hearing yesterday.

Rep. Kevin Hern (R-Okla.) said hospitals benefit from their nonprofit tax-exempt status “while delivering less charity care than their for-profit competitors” and “abuse federal programs like 340B to [increase] their bottom lines, instead of helping the patients that they’re supposed to be serving.”

Ways and Means full committee chair Jason Smith (R-Mo.) said, “Recent studies and articles have raised concerns that the level of community benefit, which includes charity care provided by tax-exempt hospitals, has been inadequate compared with the value of their tax exemption.” Some tax-exempt hospitals reportedly abuse the 340B program, have aggressive billing practices directed at patients that might quality for charity care, and pay executives outsized compensation, Smith said.

AHA General Counsel and Secretary Melinda Hatton testified before the committee but did not address the 340B program.

“Hospitals do more than any other sector of health care to promote and protect the health of their communities,” she said in her written testimony. “There is no doubt that [tax-exempt] hospitals both meet and exceed any requirements and expectations that attach to the privilege of tax exemption.” Research published last year in Health Affairs shows that tax-exempt hospitals are considerably more likely to provide unprofitable services, including psychiatric and hospice services, Hatton said.

“Tax-exempt hospitals provide a wide range of benefits most of which are publicly reported each year,” Hatton said. “Much of the benefits can be tallied from those filings and every year since reporting began they have exceeded the benefit conferred by their federal tax exemption.”