SPONSORED CONTENT

The Centers for Medicare & Medicaid Services (CMS) has issued a final rule that goes into effect on January 1, 2024 that changes the way Direct and Indirect Remuneration (DIR) fees are collected. To understand the impact of this change, let’s review some background on DIR fees:

What are DIR Fees?

DIR fees are a type of fee imposed on pharmacies, particularly those that participate in Medicare Part D. DIR fees are a complex and often controversial aspect of the pharmacy reimbursement system.

How do DIR Fees work?

DIR fees are essentially retroactive price adjustments that are made by pharmacy benefit managers (PBMs) or Medicare Part D plan sponsors to pharmacies after a prescription has been dispensed to a Medicare beneficiary. These adjustments in almost all cases will decrease the reimbursement paid to the pharmacy for a particular prescription.

What is the purpose of DIR Fees?

The stated purpose of DIR fees is to account for various factors that affect the cost of prescription drugs, such as manufacturer rebates, pharmacy performance, and other price concessions. These fees are meant to reconcile the difference between the amount initially paid to the pharmacy at the point of sale and the final amount calculated based on the factors considered.

Factors behind DIR fee changes

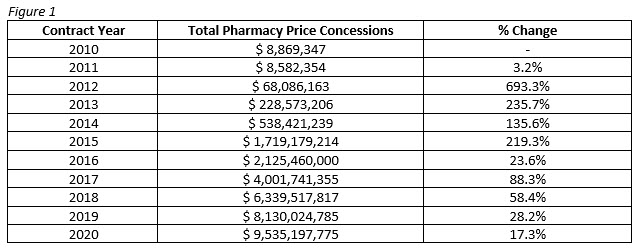

Price concessions, of which manufacturer rebates are the most significant category, are the majority component of DIR fees. These rebates are often not known at the time the prescription is dispensed, so DIR fees are used to adjust the reimbursement to account for them. Price concessions and rebates have skyrocketed since the introduction of DIR fees in 2012, to the tune of over 10,000%.

Other factors include pharmacy performance, and copay assistance programs.

Timing of DIR Assessments

One of the most contentious issues with DIR fees is the timing of their assessment. They are often not assessed until weeks or even months after a prescription has been dispensed, which can make it challenging for pharmacies to predict and budget for their expenses accurately.

Current 340B Impact

Let’s now discuss how DIR fees currently impact 340B covered entities (CEs) and how that might change in 2024. Currently, some CEs have contract pharmacy agreements in place in which DIR fees are passed through from the pharmacy to the CE, thus the CE is made to bear the burden of paying for the DIR fees. Some pharmacies submit the DIR fee invoices to CEs retroactively when the bills come in, and some attempt to estimate the fees and charge the estimated amount at the time of original pharmacy invoicing. It has been my opinion that DIR fees are the responsibility of the pharmacy and not the CE, but it is not within the scope of this article to argue that point. Nonetheless, it would be safe to say that the number of CEs currently paying for contract pharmacy DIR fees are in the overall minority.

Future 340B Impact

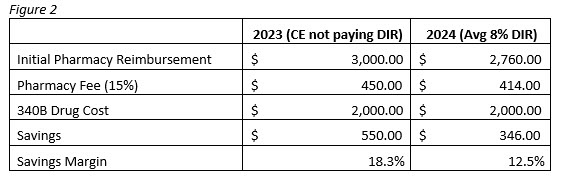

CMS’s rule prohibits the retroactive nature of DIR fee collection, meaning that pharmacies will no longer receive DIR bills months after dispensing, but will instead receive them at the time of dispensing. The exact wording of the new law changes the amount the pharmacy receives to the following: “The lowest possible reimbursement such network entity will receive, in total, for a particular drug”. What this means is that pharmacies are most likely going to see reimbursement reductions from all Part D drug plans. DIR fees can range from around 3% – 12% of the pharmacy’s initial reimbursement, with the average being around 8% anecdotally. The following exercise will demonstrate what this could potentially mean for CEs starting next year (Figure 2).

In Figure 2, we see that a CE who is not currently paying DIR fees for its contract pharmacy will generate a savings of $550 for this claim. However, once the change goes into effect in 2024 and the DIR fee is taken from the initial reimbursement, the same CE will only generate $346 in savings, a reduction of 37%. In the same example the pharmacy would have made $210 in 2023 after paying an 8% DIR fee and would make $414 in 2024, an increase of 97%. This example is not meant to pit CEs against contract pharmacies, and this change is no doubt a welcome one from pharmacy owners. However, PBMs are the ones reaping the major benefit here, in either case they are making their $240 DIR fee and that doesn’t stand to change in 2024, but the burden on who is making the DIR payment will.

Check your Pharmacy Contracts

CEs should take time now to examine their pharmacy contracts and their current exposure to Medicare Part D Plans. Entities with a large percentage of revenue coming from Part D Plans should expect to see some decrease in their net savings once reimbursements are reduced due to DIR fees. Entities in this situation may want to consider renegotiating their contract pharmacy dispense fees after taking into account this upcoming change. As a 340B Program consultant, Ravin Consultants can conduct this analysis for your organization, creating a personalized path forward and spearheading contract renegotiations. Book a consultation today to learn how we can help you.

Robert Ferraro is chief operating officer at Ravin Consultants. He can be reached at robert@ravinconsultants.com.