Some drug manufacturers have grabbed headlines and precipitated lawsuits for ending 340B pricing on drugs dispensed by contract pharmacies. But behind the scenes, drug companies also are investing in other ways to reduce their exposure to 340B program sales, which a major industry consulting firm says have been growing on average by 25 percent per year since 2014.

IQVIA Senior Principal Shiraz Hasan and General Manager Diane Weisbrod described those methods during a webinar yesterday that also addressed estimates of 340B’s size and growth, 340B covered entity and contract pharmacy growth trends, and drivers of manufacturer exposure to 340B drug discounts.

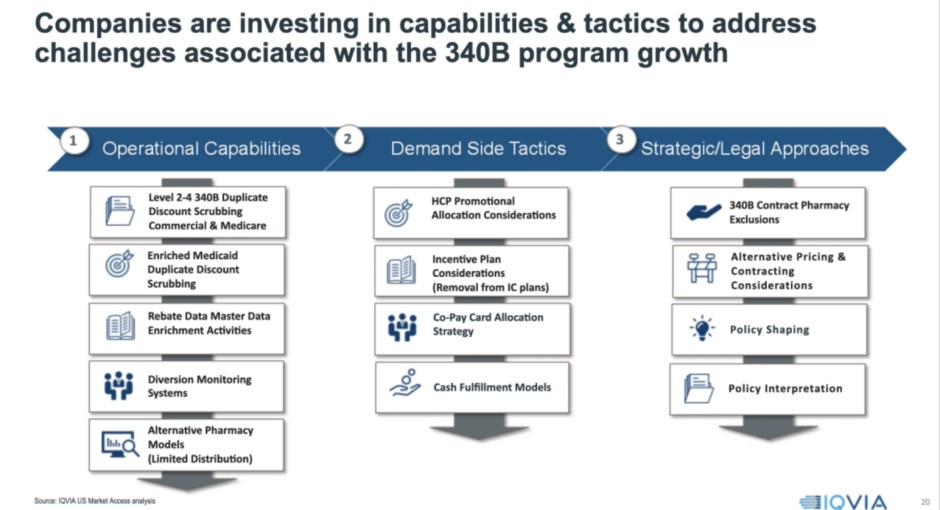

Hasan said manufacturer tactics to get a handle on 340B sales growth fall into three buckets: Strategic/legal approaches (which include manufacturers’ recent high-profile contract pharmacy actions), claims-scrubbing and other operational capabilities, and “demand-side” ways to reduce exposure to 340B discounts.

“Given the 340B growth that has happened and that we’re expecting, companies are really thinking about investing in capabilities and tactics to address these challenges,” Shiraz said.

Hasan, like many other 340B manufacturer stakeholders, described 340B discounts and Medicare, commercial, and Medicaid rebates on the same drugs collectively as “340B duplicate discounts.” Provider stakeholders argue the term should be reserved for duplicate 340B discounts and Medicaid rebates, in particular for Medicaid fee for service rebates, which is the only type of discount/rebate duplication they are legally obligated to prevent.

On the operational side, “we see many manufacturers getting better at scrubbing out their 340B duplicate discounts” with respect to commercial and Medicare rebates, Hasan said. “This is really the contract pharmacy approach, pulling in missing data and actually withholding payment for transactions that are duplicate discounts.” Manufacturers also are scrubbing claims harder for duplicate 340B discounts and Medicaid rebates, and doing more monitoring of chargebacks and direct sales in search of potential diversion of 340B drugs to ineligible patients.

Also on the operational front, drug companies want to know if they can do anything strategically to limit their distribution networks, Hasan said. They are asking, he said, “Are the current players in the distribution network contract pharmacies? Will they become contract pharmacies? Should that be decision-making criteria for what I’m doing in the marketplace?”

Reducing Demand for 340B Product

On the demand-reduction side, Hasan said manufacturers are starting to think about promoting certain products less to physicians based on whether they practice in 340B covered entities with large contract pharmacy networks. Manufacturers, he continued, are looking at how to remove 340B transactions from their pharmaceutical sales representatives’ incentive bonuses “to incentivize them to drive more profitable areas of business.” Some manufacturers are considering whether to start allocating patient co-pay cards differently based on 340B exposure. Finally, for certain products that “are under water” due to 340B discounts, especially penny-priced products, manufacturers are asking themselves if they would be better off taking patients “out of the insurance model and use a cash-discount care model instead,” he said.

Regarding strategic and legal approaches, “a lot of examples are being played out publicly now in terms of 340B contract pharmacy exclusion,” he said. Other companies, meanwhile, increasingly are thinking differently about their pricing and contracting strategies “in relationship to generating more 340B exposure, given that it can exacerbate an already negative situation,” he said.

The drug industry is trying to shape 340B policy, Shiraz said. “There are a lot of different proposals out there that could change the dynamic of the 340B program.” He said manufacturers also are concerned about 340B policy interpretation, “thinking about, ‘Is any of this enforceable? What’s our interpretation of what we can and cannot do?’ We see manufacturers thinking about this and actually digging into the weeds of the language, and trying to understand what it means for them, especially those that are really negatively impacted and with margins that are eroding.”

Other Key Takeaways

Other highlights from the webinar include:

- Manufacturers’ exposure to 340B discounts is highly dependent on disease areas. In 2019, 27 percent of oncology drug sales, just under 25 percent of antiviral drug sales, and just over 15 percent of gastroenterological drug sales were through the 340B channel, Hasan and Weisbrod said.

- 340B sales are growing faster than other outpatient prescription drug programs and is now the size of Medicaid, they said.

- Covered entities with more than 100 child sites and/or more than 100 active contract pharmacy relationships are major drivers of 340B sales growth, they said.

- Physician specialties can be drivers of 340B growth. Pediatric specialists, for example, spend 85 percent of their time practicing in 340B-eligible sites, they pointed out.

- Manufacturers are concerned about the impact expanded use of telemedicine will have on their 340B exposure after the COVID-19 pandemic ends.

- Weisbrod said the U.S. Health Resources and Services Administration’s (HRSA) statement to 340B Report last July that its 2010 contract pharmacy guidance is still in effect, but that its guidance is not legally enforceable “really set the stage” for manufacturers to follow Eli Lilly’s lead and make 340B pricing available only to single contract pharmacies for entities lacking an in-house pharmacy, or to require covered entities to share their claims data.