Drug manufacturer vendor Kalderos says it expects several companies to begin using its 340B Pay platform during the next three months.

Drug manufacturer vendor Kalderos says it expects several companies to begin using its 340B Pay platform during the next three months.

Kalderos Expects its 340B Rebate Model Will Finally Lift Off During Q1 2021

Drug manufacturer reimbursement vendor Kalderos expects “a number of manufacturers” will begin using its 340B Pay software platform during the first quarter of 2021, the company told 340B Report last night. “We are fielding a high level of interest from drug manufacturers of all sizes,” the company said.

Yesterday morning, Kalderos announced a change in how 340B Pay would work. Originally, if a drug company signed up to use 340B Pay, its covered entity customers would have had to begin buying the company’s drugs at wholesale or group purchasing cost, instead of at the lower, statutorily defined 340B price. (Manufacturers can choose to use 340B Pay for all or only some of their products.) Next, when entities dispensed a drug, they would have had to automatically transmit claims data to Kalderos. Kalderos would have checked to see if the manufacturer also paid Medicaid, Medicare Part D, or commercial rebates on the same drugs. After this verification step, Kalderos would have paid the covered entity a rebate in lieu of an up-front 340B discount.

Federal law protects manufacturers from having to pay duplicate 340B discounts and Medicaid rebates. In fee for service Medicaid, covered entities are responsible for ensuring duplication doesn’t occur. In Medicaid managed care, it is up to the states to decide how to prevent duplication. There is nothing illegal about overlapping 340B discounts and Part D and commercial rebates.

Kalderos told 340B Report this summer that 340B Pay would be configured by default to honor covered entity requests for 340B discounts in instances of duplicate Medicaid managed care, Part D, and commercial rebates. It said the final decision about how to configure 340B Pay would be up to the manufacturer, however.

Under the change announced yesterday, Kalderos now will let covered entities decide, but only for drugs they themselves dispense, whether they want reduced 340B pricing in the form of an up-front discount or a back-end rebate. For drugs dispensed at contract pharmacies, the only way to get 340B pricing will be via a Kalderos rebate.

Kalderos originally planned to make 340B Pay available to manufacturers in September. The launch, however, was scrubbed amid uproar over several drug manufacturers’ decisions this summer either to stop providing 340B pricing on drugs shipped to contract pharmacies, or to condition 340B pricing on covered entities uploading their contract pharmacy claims data to 340B ESP, a different manufacturer reimbursement vendor, so the claims could be checked for overlapping 340B discounts and Medicaid, Part D, and commercial rebates.

Some of the companies that have stopped providing 340B discounts on drugs for contract pharmacies say these discounts are not required by the 340B statute, and/or that the U.S. Health Resources and Services Administration’s (HRSA) 340B contract pharmacy guidance is not legally enforceable.

Kalderos says it is giving entities the option to stick with up-front 340B discounts for their own drugs, but not for contract pharmacy drugs, because drugs dispensed at contract pharmacies “remain the most challenging sites for compliance.”

Another possible, unstated reason, is that at least some manufacturers that plan to use 340B Pay also believe that they are under no statutory obligation to pay lower 340B prices on contract pharmacy drugs and/or that HRSA is powerless to enforce its 340B contract pharmacy guidance.

In mid-November, 173 Democratic and 44 Republican U.S. representatives asked U.S. Health and Human Services (HHS) Secretary Alex Azar in a letter to take immediate action to stop drug companies and Kalderos from changing the 340B program from a discount to a rebate model.

“This platform could make participation in 340B more difficult for covered entities, effectively reshaping the 340B program in a way that only serves manufacturers’ and these third-party vendors’ financial interests,” the lawmakers said. “These tactics open the door for significant compliance issues, threatening to put manufacturers in violation of their statutory obligation to provide 340B pricing.”

In late October, the American Hospital Association (AHA) sent HRSA a letter saying 340B Pay “directly subverts Congress’ intent” for the 340B program. It asked HRSA “to intervene and stop the drug manufacturers from employing these pernicious tactics to drastically change the 340B drug program.”

In its news release yesterday announcing its change to 340B Pay, Kalderos said it “has directly communicated the change to HHS and HRSA, which have not identified any compliance concerns with 340B Pay or its latest product update.”

In late September, HRSA told 340B Report it “is aware of the Kalderos model and is in the process of reviewing and determining next steps.” We are awaiting a comment from HRSA on Kalderos’ statement yesterday, and will update this article online if we get one.

Industry White Paper: Pharma’s 340B Contract Pharmacy Sales Down Sharply

For drug manufacturers that have restricted sales to 340B contract pharmacies, such sales in November appeared to be “less than 50 percent of what they had been” at the start of 2020, a new white paper by IQVIA’s Market Access Center of Excellence indicates.

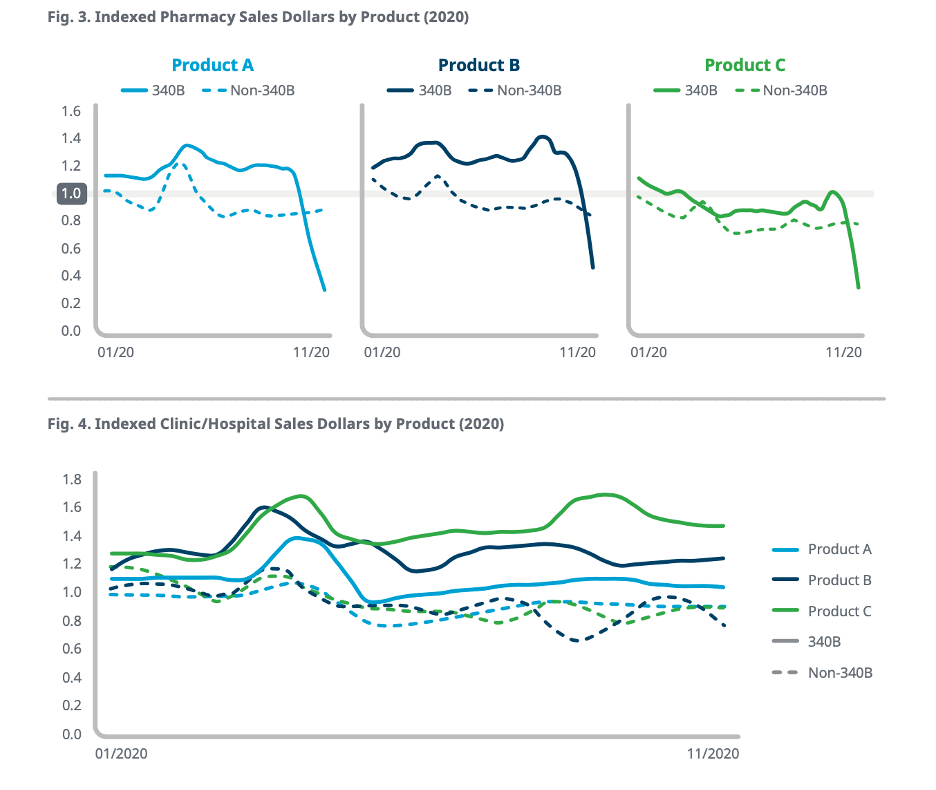

To get a sense of what was occurring market-wide, IQVIA analysts looked at “three reference products that restricted their distribution to contract pharmacies.” 340B contract pharmacy sales for all three plummeted after the restrictions were imposed. Non-340B contract pharmacy sales for the three products remained relatively stable, as did 340B and non-340B sales of the products to pharmacies located in hospitals and clinics.

SOURCE: IQVIA

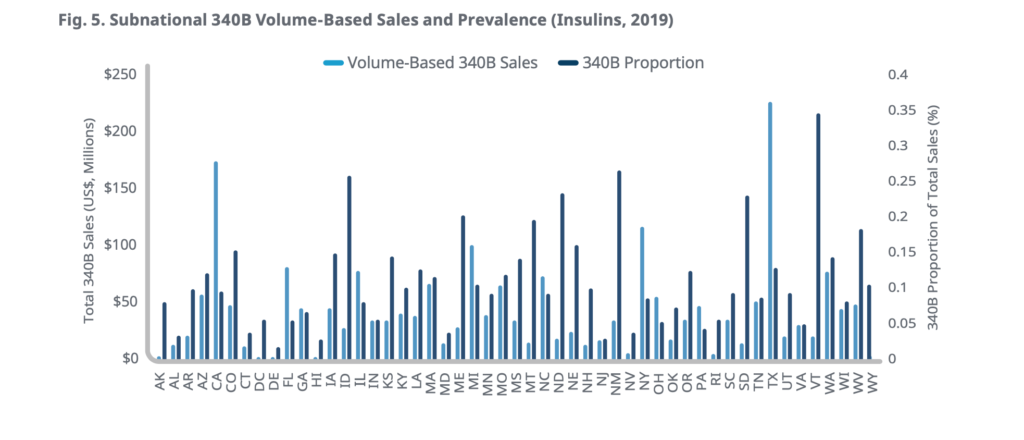

The white paper also includes a chart depicting extreme variation among states in terms of total 340B and non-340B insulin sales in 2019, both in terms of volume-based sales in dollars and 340B sales as a proportion of all sales. The chart appears to show that 340B sales of insulin as a proportion of all sales ranged from about 35 percent in Vermont to under 5 percent in Alabama, Connecticut, Delaware, Hawaii, Maryland, New Jersey, and Nevada. We’ve asked IQVIA if we are reading the chart correctly.

The chart, unfortunately, does not show states’ 340B contract pharmacy sales of insulin as a proportion of all sales. All three U.S. domestic insulin manufacturers —Eli Lilly and Co., Sanofi, and Novo Nordisk—either have stopped or imposed conditions on insulin sales shipped to 340B contract pharmacies.

SOURCE: IQVIA

Drug Companies Denying 340B Pricing Spend Billions on Acquisitions

Two drug manufacturers denying safety-net health care providers 340B pricing on their products recently announced billion dollar deals to buy other manufacturers.

AstraZeneca announced Dec. 12 is acquiring Alexion Pharmaceuticals for $39 billion—a figure $14 billion above total national 340B program drug sales of about $24 billion in 2018, as reported by the U.S. Health Resources and Services Administration (HRSA) in its last budget request to Congress. Alexion makes two of the most expensive drugs sold in the U.S.—Soliris (list priced at $50,000 per year) and Ultromiris ($485,000 per year).

Eli Lilly and Co. announced on Tuesday it will buy Prevail Therapeutics, an investigatory gene therapy company, for just over $1 billion.

Lilly and AstraZeneca both are declining to provide 340B pricing on their products shipped to 340B covered entities’ contract pharmacies.

CMS: Retail Rx Drug Spending Rose 5.7% in 2019

U.S. retail prescription drug spending (manufacturer revenues net of rebates and discounts) reached $369.7 billion in 2019, up 5.7 percent from the year before, U.S. Centers for Medicare & Medicaid Services (CMS) statisticians write in the latest edition of the journal Health Affairs.

Prescription drug prices declined 0.4 percent in 2019 “as price growth slowed for brand-name drugs and declined for generic drugs,” CMS said, citing unpublished U.S. Bureau of Labor statistics on inflation. Although generic drugs now constitute 86.3 percent of all drugs dispensed, brand-name drug sales account for 80 percent of total prescription drug revenues, it said. “A continuation of the increase in use of lower-priced generic drugs helped to offset growth in the use of higher-priced brand-name drugs,” CMS said.

CMS observed that drug manufacturer rebates “increased at the slowest rate since 2012.”

CMS said growth in retail prescription drug spending was influenced by growth in the total number of retail prescriptions dispensed (up 3.2 percent in 2019), and “by continued strong growth in spending on prescription drugs that are used to treat autoimmune disorders, cancer, and diabetes.”

Private health insurance was the largest payer for retail prescription drugs (45 percent, followed by Medicare (28 percent) and out-of-pocket spending (18 percent). CMS didn’t supply a figure for Medicaid.

Also in CMS’s annual national health expenditures report, the agency said there were 31.8 million uninsured persons in the U.S. in 2019, up 3.8 percent from 2018. The insured share of the total U.S. populations has declined from 91.1 percent in 2016 to 90.3 percent in 2019. This year’s uninsured rate is expected to rise due to job losses caused by the COVID-19 pandemic.

Powerful Union Joins Fight Against New York Medicaid Cuts to 340B Providers

A New York State coalition of health care providers and progressive activists today gained a strong political ally in their campaign against an upcoming state Medicaid prescription drug policy change they say will harm HIV/AIDS clinics, other safety-net health care providers enrolled in 340B, and their patients.

1199 SEIU, the Service Employees International Union local that represents health care workers in New York and five other eastern states, this morning joined Save NY’s Safety Net, which supports legislation to delay the effects of budget legislation enacted last spring that will transfer Medicaid prescription drugs from managed care and move them into Medicaid fee for service (FFS) effective April 1, 2021. Under Medicaid FFS, 340B providers would have to bill the state for 340B-purchased drugs at actual acquisition cost plus a dispensing fee. The legislation would shield 340B providers from the move’s effects for three years.

1199 SEIU is a big force in New York politics. Its president, George Gresham, was one of the state’s 29 U.S. presidential electors this week, serving with other power brokers including former President Bill Clinton and 2016 Democratic presidential candidate Hillary Rodham Clinton. Gov. Andrew Cuomo (D) also was an elector. He and state lawmakers are the target of Save NY’s Safety Net’s campaign. Sources say the bill to protect 340B providers from the benefit transfer has support in the legislature.