Drug manufacturer Lilly’s announcement last week that it is slashing the price of Humalog, its most commonly prescribed insulin, may have been less about altruism and more about avoiding exposure to bigger Medicaid rebates, a prominent drug pricing expert says.

Sean Dickson, whose last day as director of health policy at West Health Policy Center was Friday, laid out his argument in a March 1 Twitter thread.

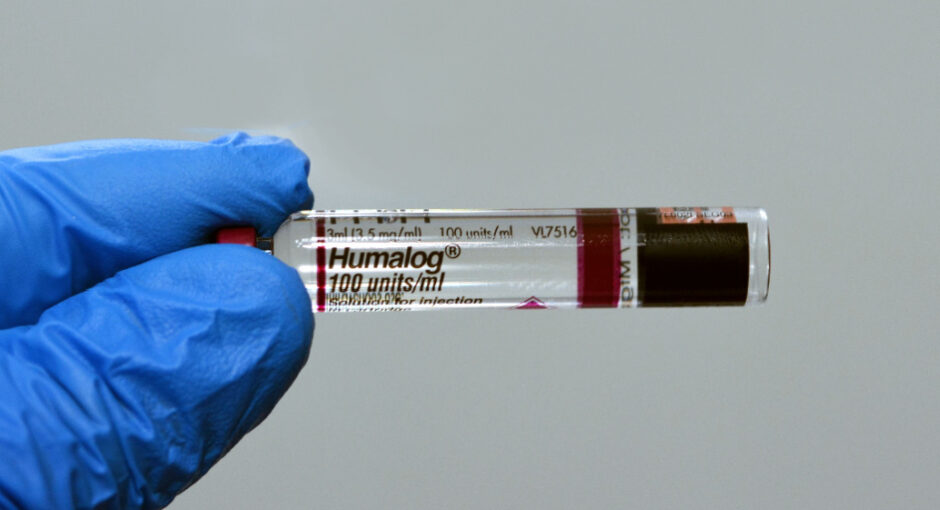

Lilly said that day it was

- cutting Humalog’s list price by 70% effective Q4 2023

- dropping the price of its non-branded version of Humalog (insulin lispro injection, a fast-acting insulin) to $25 a vial effective May 1

- launching Rezvoglar (a biosimilar version of Sanofi’s long-acting insulin Lantus) on April 1 at $92 per five-pack, a 78% discount relative to Lantus.

“The aggressive price cuts we’re announcing today should make a real difference for Americans with diabetes,” Lilly’s Chair and CEO David A. Ricks said.

Lilly’s insulin price reduction “has important Medicaid implications,” Dickson said in his Twitter thread. He noted that under federal COVID-19 relief legislation signed in March 2021, starting next year Medicaid drug rebates will no longer be capped at 100% of average manufacturer price.

Currently, under the Medicaid drug rebate program’s inflation penalty, if a covered outpatient drug has a history of large price increases, the rebate owed can be as great as AMP but no greater. Starting Jan. 1, 2024, the rebate owed can go beyond AMP.

340B program guidance keeps the Medicaid drug rebate program’s inflation penalty from resulting in a negative 340B price. One cent is the lowest a 340B price can go, and there are no known plans to change that.

Dickson said by cutting Humalog’s price now, Lilly can avoid paying the enhanced Medicaid rebate inflation penalty that starts next year. “Sales to Medicaid (and the 340B program) may now actually generate revenue instead of costing the company,” he said.

Something similar occurred in 2018 when hepatitis C virus treatments fell, Dickson said. “Mandatory 340B discounts were likely the cause—manufacturers found it more profitable to lower list prices than offer big discounts.”