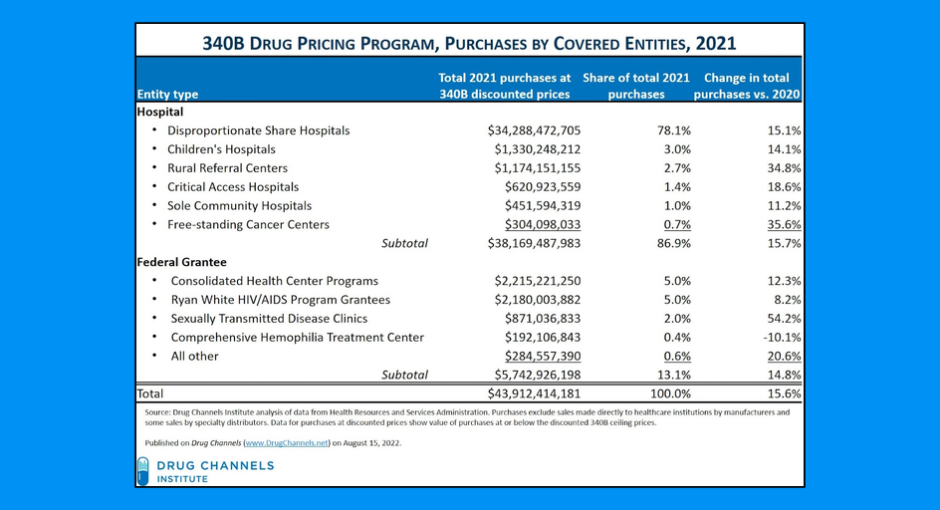

Total sales in the 340B drug pricing program reached $43.9 billion in 2021, a 15.6% increase over 2020 sales and more than 3.5 times above total sales in 2015 ($12.1 billion), according to federal data obtained by Drug Channels Institute under the Freedom of Information Act.

The institute is led by drug industry consultant Adam Fein, creator of the influential Drug Channels blog and a leading critic of hospitals that participate in 340B. For several years Fein has obtained the government’s most up-to-date 340B sales figures under FOIA and reported them in his blog. The U.S. Health Resources and Services Administration reports the same or slightly adjusted data months later in its annual budget requests to Congress. The figures come from Apexus, the 340B prime vendor, and do not include manufacturer direct sales to entities.

Fein this year asked HRSA to break out 340B sales data by covered entity type. HRSA reported that hospital entities accounted for 86.9% of 340B sales in 2021 and grantee entities for 13.1%.

Among hospital entities, disproportionate share hospitals (DSH) were the largest purchasers of 340B priced drugs last year ($34.2 billion, 78.1% of all 340B program sales), followed by children’s hospitals ($1.3 billion, 3.0%), rural referral centers ($1.7 billion, 2.7%), critical access hospitals ($620 million, 1.4%), sole community hospitals ($451 million, 1.0%), and free-standing cancer hospitals ($304 million, 0.7%).

DSH hospitals’ share of total 340B program sales grew from just over half (52.0%) in 2015 to just over three quarters (78.1%) last year, the data show.

Among grantee entities, consolidated health center programs were the largest 340B program purchasers in 2021 ($2.2 billion, 5.0% of all 340B program sales), followed closely by Ryan White HIV/AIDS program grantees ($2.1 billion, also 5.0%). Sexually transmitted disease clinics ranked third ($871 million, 2.0%). All other grantee types collectively accounted for about 1.0% of 340B sales.

340B sales to some types of entities declined from 2020 to 2021, including comprehensive hemophilia treatment centers (from $213 million to $192 million) and family planning clinics (from $83.8 million to $74.9 million).

340B sales through the ADAP rebate option were $125,873 in 2015, dropped to just $724 in 2017, climbed back to $31,728 in 2020, then fell again last year to $23,336.

“340B advocates have been screaming that ‘drug companies are cutting 340B,’ but the data tell a very different story,” Fein commented in his blog about the 2021 sales figures. “Congress has just passed the Inflation Reduction Act, which will sharply reduce pharmaceutical manufacturers’ revenues. It’s long past time for legislators to revisit the out-of-control and unregulated 340B program.”