Health centers and other federal grantees’ 340B savings and how they use them need more scrutiny, as these covered entities account for a large chunk of total 340B drug sales and their margins are keeping pace with those of hospitals, a new drug company-funded study says.

The study was funded by drug maker Gilead Sciences, whose products include treatments for HIV/AIDS and hepatitis often prescribed by 340B grantee entities. Berkeley Research Group, the company that established drug industry 340B contract pharmacy policy administrator 340B ESP, conducted the study released on May 22. Gilead Chair and CEO Daniel O’Day is PhRMA’s board chair-elect.

The study was issued the same week as the U.S. House Energy & Commerce Committee voted largely on party lines to impose reporting requirements on 340B disproportionate share hospitals and gave the U.S. Department of Health and Human Services the power to impose reporting requirements on any other types of covered entities.

The analysis suggested that grantees’ share of total 340B revenues is likely higher than what government data show and that grantees’ use of contract pharmacies is growing faster than that of 340B hospitals. While some grantees may have to report on their use of 340B income to their funding agencies, this reporting is generally not publicly available, the report noted.

“Without greater transparency it is unclear to what extent federal grantee clinics depend on the drug margin earned from the 340B program to fund their operations, whether patients benefit from these funds, and whether this is a sustainable approach to funding these services going forward,” the study said.

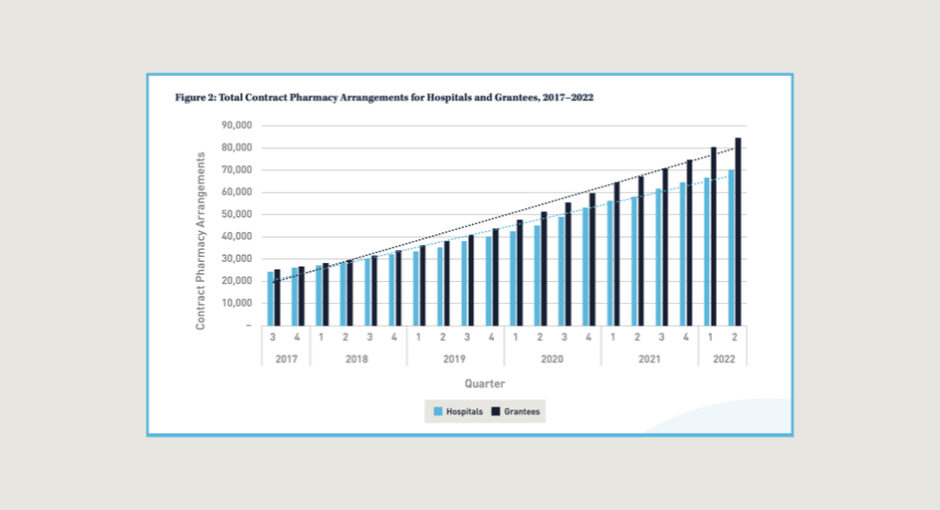

The rapid growth in 340B purchases by hospitals and grantees is driven by many of the same factors, including increased 340B program participation and expanded use of contract pharmacies, the study found.

The analysis showed that grantees and their contract pharmacies generated $13 billion to $17 billion in reimbursement for 340B-purchased drugs in 2020, for which they paid $5 billion at the discounted price, giving them $8 to $12 billion in 340B savings in one year. “The portion of that margin retained by contract pharmacies or other vendors is not known,” the researchers said.

Other key findings from the study included:

- Grantees accounted for 13.1% of 2021 sales at the discounted 340B price.

- Between 2020 and 2021, 340B program sales to grantees rose by 14.8%, versus by 15.7% for hospitals.

- The number of contract pharmacy arrangements involving grantees exceeds the number involving hospitals. Grantee contract pharmacy arrangements rose 252% between 2017 to 2022, compared to 194% for hospitals.

- Health centers accounted for 64% of 340B grantee entity contract pharmacy arrangements as of Q2 2022. STD clinic 340B contract pharmacy arrangements grew the fastest in terms of percentage over the last five years.

- Based on an analysis 2020 Medicare Part D data for the top 100 brand drugs dispensed to beneficiaries, grantees’ total reimbursement for 340B drugs is more than 3.7 times as large as the estimated 340B price. The estimated average 340B discount from wholesale acquisition cost is 73%.

- Grantees’ public-payer reimbursement accounts for nearly 70% of their 340B drug margin—Medicaid manage care plans for 36% and Medicare for 30%. Grantees “likely use the significant share” of public-payer reimbursement “in part to compensate [contract pharmacy] vendors in the form of enhanced dispensing fees for 340B transactions.”