California will start making its own insulin under a state budget bill Gov. Gavin Newsom (D) signed June 30.

The bill includes $50 million to develop three low-cost biosimilar insulin products and another $50 million for a California-based insulin-manufacturing facility.

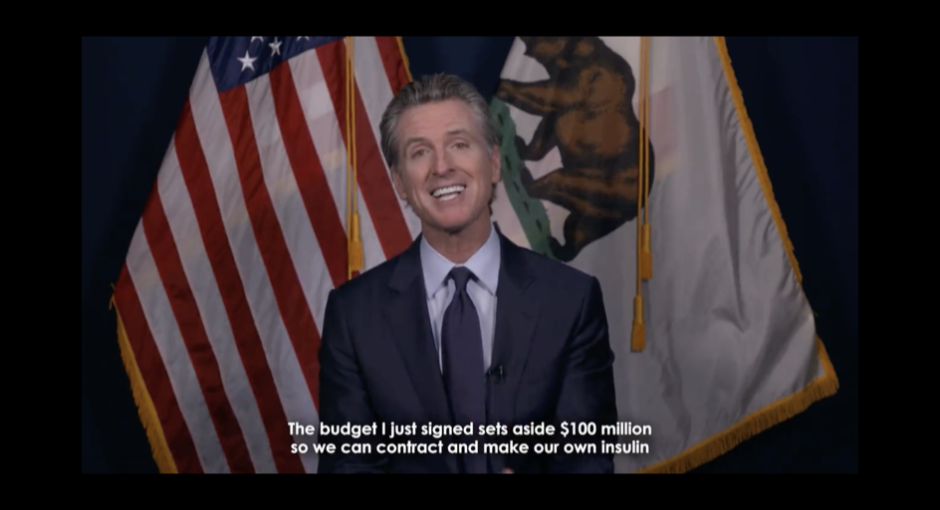

“Nothing epitomizes market failures more than the cost of insulin,” Newsom said in a July 7 video on Twitter, noting that many patients with diabetes spend $300 to $500 per month on insulin therapies. “California is now taking matters into our own hands,” he said. “We can contract to make our own insulin at a cheaper price, close to at-cost, and to make it available to all.”

“People should not go into debt to receive life-saving medication,” Newsom said.

340B and Insulin

Insulin makers Eli Lilly, Sanofi, and Novo Nordisk and diabetes drug maker AstraZeneca were among the first drug companies to impose conditions on 340B pricing on drugs shipped to contract pharmacies. New York state and Virginia health centers have filed a federal antitrust suit against the four companies over their 340B contract pharmacy restrictions. The Biden administration rescinded a Trump administration rule requiring community health centers to pass along all their 340B savings on insulin to low-income patients with high-cost or no health insurance.

California’s initiative builds on other insulin cost-cutting efforts. In March, nonprofit drug manufacturer CivicaRx announced plans to manufacture and distribute insulins that, once approved, will cost no more than $30 per vial and no more than $55 for a box of five pen cartridges—significantly less than insulins now on the market.

A bipartisan bill unveiled in the U.S. Senate late last month would incentivize insulin makers to reduce their list prices. Insurers and pharmacy benefit managers would be prohibited from getting rebates on insulins if their manufacturers cap the list price to the 2021 net prices for Medicare Part D or equivalent levels. It would also waive deductibles for insulins and cap copays at $35 per month or 25% of the list price.

The PBM industry opposes the Senate legislation which it contends unfairly targets their industry and goes lightly on drug manufacturers. Senate Majority Leader Chuck Schumer (D-N.Y.) pledged to hold a floor vote on the bill “very soon.” A similar bill passed the House in March.

The U.S. insulin market was estimated at just over $20 billion in 2021, with roughly half of that attributed to Novo Nordisk products, and Lilly and Sanofi insulin drugs accounting for about one-quarter market share each.According to the American Diabetes Association 34 million Americans have diabetes, 88 million have prediabetes, and 1.4 million will be diagnosed with diabetes this year. The average price of insulin in the United States in 2018 was more than ten times higher than the average in 33 countries in Europe, Asia, Australia, and the Americas, a RAND study for the U.S. Department of Health and Human Services found.