SPONSORED CONTENT

Numerous studies have demonstrated how patient medication adherence impacts long-term outcomes and healthcare costs.

Drug manufacturers consistently work to refine their current products, and to create new ones, in order to increase patient adherence. Medications that once needed to be administered multiple times per day, now come in extended-release versions that require only one daily dose. Manufacturers have succeeded in combining multiple drugs into single tablet regimens. This trend is evident in the evolution of HIV regimens over time. One of the first combinations of anti-retroviral therapy used to treat HIV patients required patients to take almost 20 pills per day. Now, many of the most widely used medications for managing HIV consist of only one pill, once per day.

The Next Generation

Recently, manufacturers have taken it a step further–introducing long-lasting injectable medications. Examples include Cabotegravir/rilpivirine (CABENUVA), a monthly injection to manage HIV, and long-acting buprenorphine (SUBLOCADE®), a once-a-month injection, used to help manage opioid addiction. This trend is likely to continue. Without a plan, 340B administrators may find themselves playing catch-up.

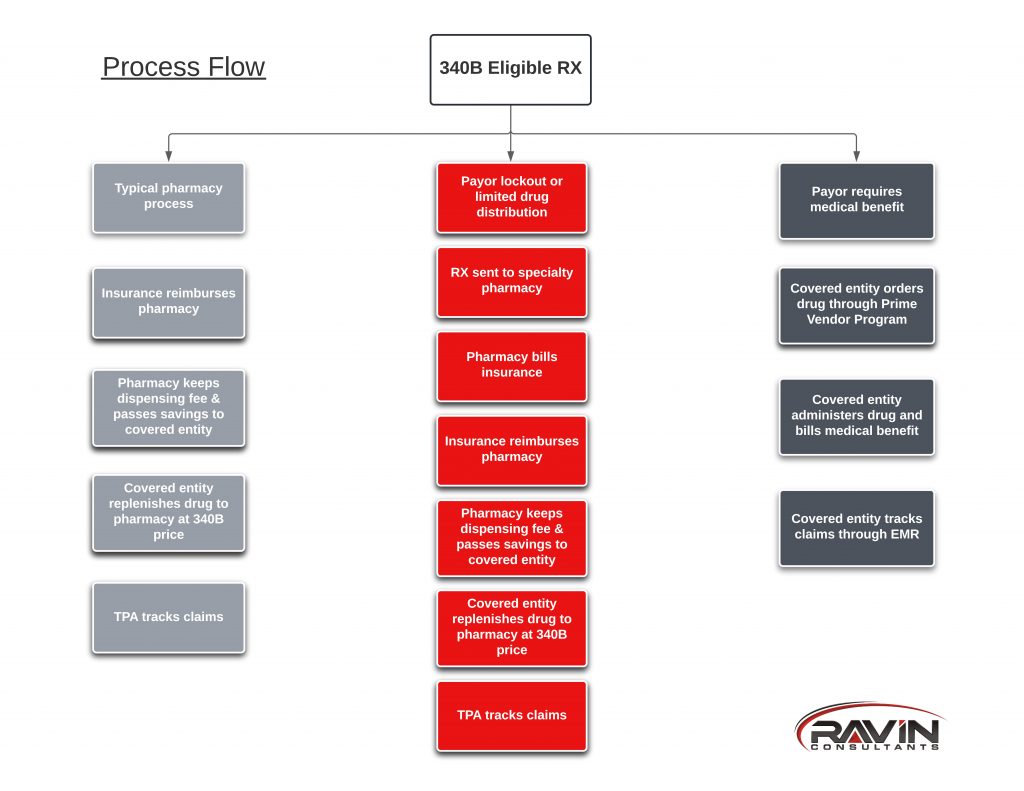

Billing Challenges As more patients switch from oral formulations to monthly injections, covered entities are already raising concerns that their 340B savings are decreasing. This decrease in savings is due to billing inconsistencies between different payers. For example, a patient taking an oral medication is, in most cases, a straight-forward pharmacy transaction. The pharmacy bills the insurance in real-time, collects payment, keeps the pharmacy dispensing fee, and transfers the savings to the covered entity, who then purchases the replenishment medication at 340B cost and sends it to the pharmacy.

With these new monthly injectable medications, the process in some cases is the same as outlined above. However, in many instances, payers are mandating that these injectable medications be billed through a patient’s medical insurance instead of their pharmacy benefit. This means that the covered entity orders the medication directly through their wholesaler and is delivered straight to the covered entity location. When this happens, the transaction bypasses the pharmacy altogether, and therefore, in most cases, the covered entity’s Third Party Administrator (TPA) also has little to no visibility into the transaction. This billing change is the reason that covered entities might appear to be seeing less savings as patients change from oral formulation to injectable ones. In reality, if covered entities are tracking the usage of these medications appropriately, and ordering them through the Prime Vendor Program, they should not see any difference in savings, and in some cases will see an increase due to the reduction in pharmacy dispense fees.

Prime Vendor Program (PVP)

If your covered entity is not registered for the government’s Prime Vendor Program (PVP) operated by Apexus, you could be missing out on an entire subset of 340B savings. According to the PVP website:

“The 340B Prime Vendor Program (PVP) is a contract awarded by HRSA, which is responsible for supporting the 340B Drug Pricing Program. The Prime Vendor negotiates pricing discounts with participating manufacturers, provides education and resources such as 340B University, and offers technical assistance through Apexus Answers. The PVP is a voluntary program for covered entities and manufacturers alike. There is no fee for eligible covered entities to enroll and participate in the program.”

The PVP allows covered entities to order medications for in-office use at 340B pricing. Examples include:

- Vaccines

- Antibiotic injections like BICILLIN®

- CABENUVA

- SUBLOCADE®

The same 340B eligibility rules apply. However, instead of generating savings through the difference between pharmacy reimbursement and 340B cost, savings are generated through the difference between clinic reimbursement for drug administration and 340B cost. Consequently, these savings are tracked through the Electronic Medical Record instead of TPA software. In many cases, 340B savings may be greater because covered entities will not pay any pharmacy dispensing fees in these situations.

Most large 340B entities already use the PVP. However, many Sexually Transmitted Disease (STD) and Ryan White (RW) grantees, as well as Federally Qualified Health Centers/Look-a-like (FQHC) find themselves in uncharted territory with respect to these changes.

Putting it All Together

Even though a medication is no longer processed through the pharmacy, does not mean that the covered entity should not see any 340B savings. We recommend that covered entities create a system to track all PVP orders, then connect the drugs to 340B eligible patients.

More to consider: Some of the newer medications have been classified as Limited Distribution Drugs (LDDs). This means that the manufacturer only allows certain specialty pharmacies to access their drug. Covered entities must keep track of which pharmacies have access to which medications and ensure that they are registered as a contract pharmacy. The same goes for payer lockouts. Payer lockouts are similar to LDDs, but instead of the drug manufacturer, the patient’s insurer dictates which specialty pharmacy must be used to fill the prescription. In either case, keep an eye on your pharmacy network to make sure you’re not missing out 340B savings.

Still unsure how to best prepare to use the PVP in compliance with the 340B Program? Robert Ferraro can be reached at robert@ravinconsultants.com and would be happy to discuss this opportunity further with you.

Robert Ferraro, PharmD, MBA 340B-ACE, is Chief Pharmacy Officer at Ravin Consultants.