Part 1 of 6—Why Can So Few 340B Hospitals Buy and Dispense the Highly Profitable Cancer Drug Revlimid?

Possibly more than a thousand hospitals in the 340B drug discount program can’t buy or dispense Revlimid, a widely-used oral drug to treat the incurable cancer multiple myeloma in adults. The same is true for the related but less-used oral myeloma drugs Pomalyst and Thalomid. If these 340B hospitals could buy the drugs, dispense them to myeloma patients, and bill the patients’ payers for the medicines, they potentially could collectively receive hundreds of millions of dollars a year in 340B savings and revenue—money they could use to “stretch scarce Federal resources as far as possible, reaching more eligible patients and providing more comprehensive services,” as Congress said it intended when it created 340B in 1992.

Celgene, which Bristol Myers Squibb (BMS) fully acquired and assumed in 2019 for $74 billion, makes the three medicines. All can cause fetal death or severe birth defects when taken by women who are pregnant or plan to become pregnant. Celgene/BMS says, to prevent such tragedies, it lets only about two dozen specialty pharmacies and fewer than 250 providers buy, prescribe, and dispense Revlimid, Pomalyst, and Thalomid.

340B covered entities are among the fewer than 250 providers in BMS/Celgene’s limited distribution network (LDN) and a BMS/Celgene spokesman told 340B Report that the company “does not discriminate against 340B covered entities.” However, BMS/Celgene declined to provide details on how many or what types of 340B covered entities are in the LDN.

In a limited distribution notice on the U.S. Health and Human Services Office of Pharmacy Affairs’ web site, Celgene/BMS says letting more providers into the LDNs for the three drugs “could unnecessarily weaken the operation and effectiveness” of its Risk Evaluation and Mitigation Strategies (REMS) for the drugs that are directed by the U.S. Food and Drug Administration, “and could make certification, training, auditing, and monitoring requirements of the REMS infeasible.” It says it picked the providers based on their ability to protect patient safety and serve a broad patient base, not on their 340B status. 340B covered entities are proportionately represented in its limited distribution networks for the three drugs, it says.

“To date, there have been no reported congenital malformations associated with our products in over one million prescription cycles,” Celgene/BMS says on the BMS website. “We firmly believe that our commitment to developing highly effective REMS programs and our unwavering efforts to operate these systems have allowed hundreds of thousands of patients to access these medications while preventing the serious risks associated with embryo-fetal toxicities.”

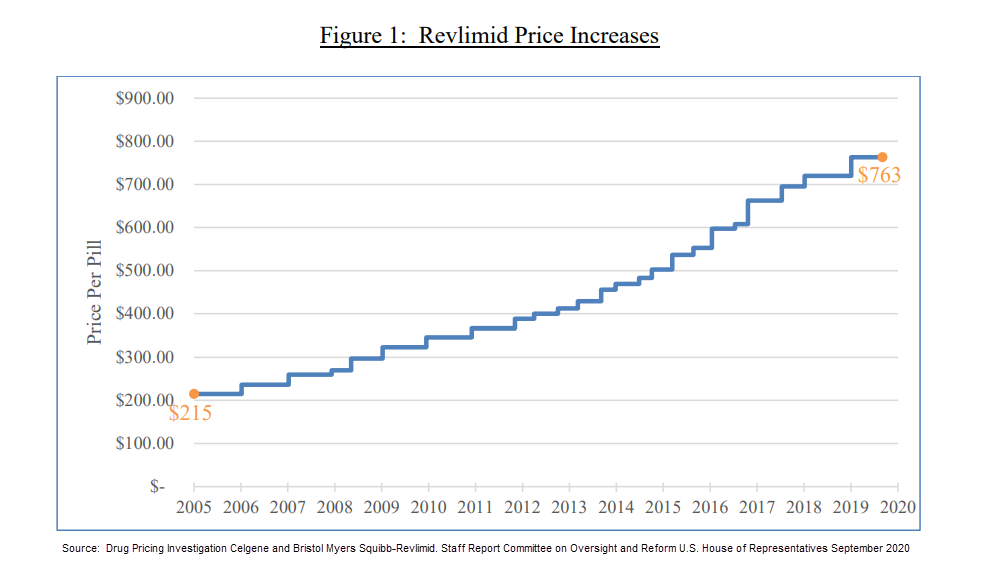

Last September, the majority staff of the U.S. House Committee on Reform and Oversight published a report focused on Celgene’s pricing practices regarding Revlimid. After reviewing more than 50,000 pages of internal communications and data from 2009 to November 2019, the committee found what it described as “uninhibited price increases” for Revlimid. Since launching the drug in 2005, Celgene raised the price of the product 22 times, from $215 per pill to $719 per pill, according to the report. After BMS obtained the rights to Revlimid in November 2019, it raised the price of Revlimid again, to $763 per pill, the report said. Due to these price increases, a monthly course of Revlimid is priced at $16,023 today—more than triple the 2005 price, the report found. These price hikes represent a 254 percent increase. (The cumulative U.S. inflation rate for urban consumers, CPI-U, for that same 14-year time span was 30.9 percent). Under the 340B law, pharmaceuticals are subject to significant additional discounts if the drug’s price increases faster than the rate of inflation.

Health systems and hospitals say the impact of being unable to access Revlimid at the 340B price is significant, financially and in terms of patient care.

340B hospital pharmacy officials told us that, by not letting them buy and bill for Revlimid, Celgene/BMS denies them 340B income that Congress wanted them to have to serve more patients and improve care. They say their in-house or contract specialty pharmacies can handle drugs with REMS as well as or better than Celgene/BMS’s chosen pharmacies. And by making the systems’ patients with multiple myeloma get Revlimid from BMS/Celgene’s small, closed networks of specialty pharmacies or authorized hospitals and clinics, instead of from the systems’ own or contracted specialty pharmacies, Celgene/BMS interposes itself in the health systems’ coordination of their patients’ care. This takes away from, not adds to, patient safety, the health systems argue. They also argue that their exclusion from the networks undermines their safety net mission.

Celgene/BMS says its limited distribution networks for Revlimid, Pomalyst, and Thalomid are motivated by patient safety and are equitable. The company told 340B Report that Celgene was audited by the U.S. Health Resources and Services Administration (HRSA) and received no adverse findings.

340B health systems and hospitals say they suspect Celgene/BMS’s tight restrictions on the drugs are motivated by profit. In 2018, an ex-Celgene vice president with over 30 years of pharmaceutical industry experience sided with the health systems and hospitals.

Thursday in Part 2: A Pharmaceutical Industry Insider’s Claims of Massive Fraud Against 340B Providers

Learn more about the ex-Celgene vice president’s allegations of serious fraud, which the former executive said went to the top of the company’s C-suite, in our next installment of 340B Report’s first investigative series.

Part 1 of this investigative series is free, but only paid subscribers will be able to access the remaining five parts of this groundbreaking series. Part 2 will be published on Thursday, June 3. Take advantage of our lowest-ever discount opportunity: 25% off our regular subscription rates, only available through June 11. Subscribe now using coupon code INVESTIGATE25. For questions, please contact reshma.eggleston@340breport.com.