Drug manufacturers often observe that a growing share of their take from gross sales goes to middlemen and others in the form of rebates and discounts. A term has been coined to describe the phenomenon: the gross-to-net bubble (the difference between list and net drug prices).

A study published yesterday in JAMA Network Open for the first time gets at the degree to which these losses are due to voluntary discounts that manufacturers negotiate with PBMs in the commercial and Medicare Part D markets versus mandatory government discounts such as ones provided to 340B covered entities.

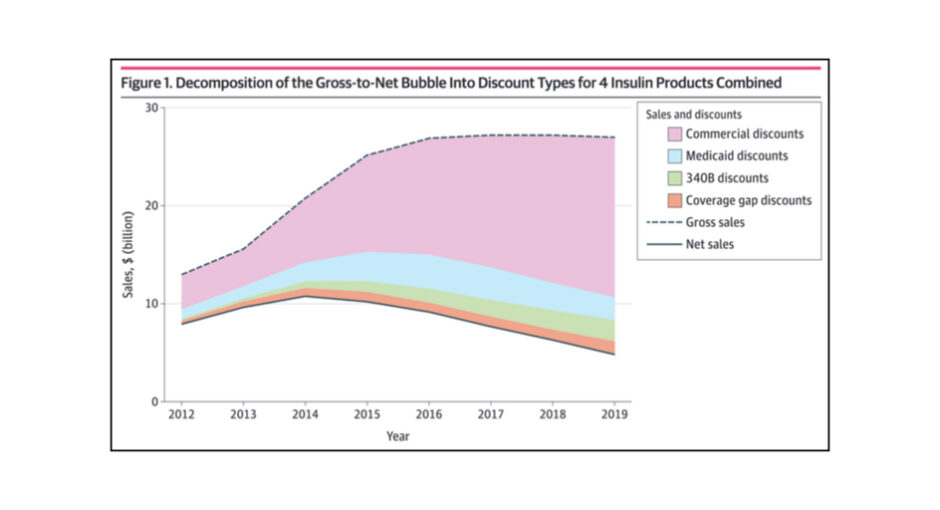

The study “decomposed” all discounts from 2012 to 2019 for the top four commonly used insulin products—Lantus (Sanofi), Levemir (Novo Nordisk), Humalog (Lilly), and Novolog (Novo Nordisk)—into four types: (1) Medicare Part D coverage gap discounts, (2) Medicaid discounts, (3) 340B discounts, and (4) commercial discounts.

Discounts as a Proportion of Gross Sales

It found that total discounts increased from 37.6% ($4.9 billion) to 81.4% ($22.0 billion) of gross sales from 2012 to 2019.

“Voluntary, negotiated discounts represented most of the discounts,” the study said. They more than doubled, from 27.0% ($3.5 billion) to 60.5% ($16.4 billion) of gross sales over the study period.

Mandatory discounts grew from 10.7% ($1.4 billion) of gross sales in 2012 to 21.0% ($5.7 billion) in 2019. Among these, 340B discounts grew from 1.2% ($160 million) of gross sales in 2012 to 8.0% ($2.2 billion) in 2019, the study said.

During this period, all four insulin products had price increases in excess of inflation, triggering statutory caps on Medicaid rebates (100% of a drug’s average manufacturer price) and on 340B discounts (a ceiling price of $0.01). Novolog hit the cap in 2013, Humalog in 2014, Lantus in 2015, and Levemir in 2019. 340B use of all four drugs, not surprisingly, increased from 1.5% of units sold in 2012 to 7.4% of units sold in 2019, the study said.

Lantus 340B discounts grew from 1.0% ($54 million) of gross sales in 2012 to 8.2% ($601 million) in 2019. Levemir 340B discounts grew from 0.6% ($9 million) to 7.6% ($297 million), Humalog 340B discounts from 1.6% ($40 million) to 7.1% ($541 million), and Novolog 340B discounts from 1.6% ($58 million) to 8.8% ($720 million).

Commercial and Mandatory Discounts’ Shares of Total Discounts

Commercial discounts’ share of total discounts, aka the gross-to-net bubble, increased from 71.7% in 2021 to 74.3% in 2019. Mandatory discounts’ share fell from 29.3% to 26.7%.

Within the mandatory discount category, 340B discounts share of the gross-to-net bubble rose from 3.3% to 9.8%, Medicaid’s share fell 19.7% to 10.6%, and Part D coverage gap discounts held mostly steady (from 5.4% to 5.3%).

Conclusions

“While both commercial and mandatory discounts increased over the study period as a proportion of gross sales, commercial discounts increased at a faster rate than mandatory discounts,” the study said. “These patterns demonstrated that commercial discounts are a greater contributing factor in reduced net sales than mandatory discounts. Mandatory discounts declined as a proportion of total discounts over the period, rebutting manufacturer arguments that mandatory discounts play a role in the rising gross-to-net bubble for insulin products.”

The researchers said that as all four insulin products triggered the caps on Medicaid rebates and 340B ceiling prices, their manufacturers kept raising list prices and offering more commercial discounts.

The study noted that in recent months Sanofi announced a 78% price cut for Lantus, Novo Nordisk a 65% cut for Levemir and a 75% cut for Novolog, and Lilly a 70% cut for Humalog.

“These price reductions have been partially attributed to the lifting of the Medicaid rebate cap in 2024, under which manufacturers would have had to pay rebate penalties to Medicaid,” it explained. “By decreasing the list price and presumably rebates, manufacturers will lower base rebates under the best-price provision and inflation rebates that are triggered by year-over-year increases in list prices above inflation. The announced price reductions are greater than the estimated commercial discounts for 2019, suggesting that commercial price competition has continued to reduce net prices since 2019.”

“Mandatory discounts under federal programs, including Medicare Part D coverage gap, Medicaid, and 340B, remained less than 30% of all discounts over the period, with Medicaid rebates accounting for most of the discounts,” the study said. “As policymakers consider options to make insulin more affordable, they should consider the growing role of commercial discounts provided by drug manufacturers in reducing net sales compared with mandatory discounts required under federal programs.”

The study was conducted by Sean Dickson (formerly of West Health Policy Center, now with America’s Health Insurance Plans), Nico Gabriel and Inmaculada Hernandez of the University of California–San Diego School of Pharmacy and Pharmaceutical Sciences, and Walid Gellad of the University of Pittsburgh School of Medicine and Veterans Affairs Pittsburgh Healthcare System. It was funded by West Health.

In an invited accompanying commentary, Dr. William Feldman of Brigham and Women’s Hospital and Harvard Medical School and Dr. Benjamin Rome of Brigham and Women’s said, “The pricing bubble may have burst for several insulin products, but similar pricing bubbles for many other brand-name drugs continue to harm patients who need these drugs.”

“Policy makers should consider additional opportunities to improve transparency and ensure the affordability of prescription drugs,” they wrote. “For example, the federal government could negotiate prices for prescription drugs as soon as they are launched, as is done by most other developed countries. Policy makers could also prohibit confidential rebates, particularly for federal programs like Medicare, although an attempt to ban rebates in 2020 by the Trump Administration was abandoned after government economists found that this approach would likely raise federal spending. At a minimum, Congress should build on the bipartisan support that now exists for PBM regulation to promote better pricing transparency and ensure that negotiated discounts are shared directly with patients who use expensive brand-name drugs.”