In less than two years, brand drug companies that now must sell their products to 340B covered entities for a penny due to a history of price increases above inflation may have to start paying entities for their drugs instead of getting paid for them, a biopharma business intelligence firm warns in a new issue brief.

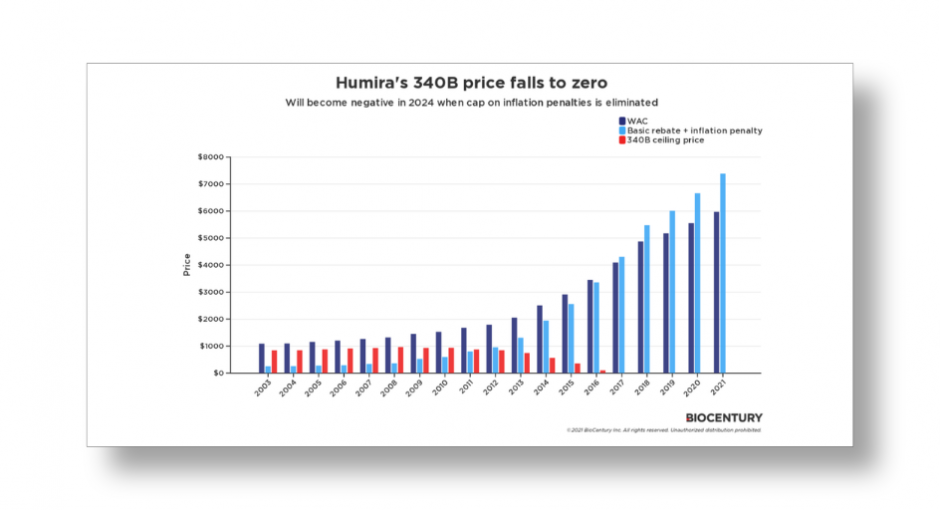

BioCentury analyst Richard Guy describes what could happen starting in 2024 to 340B pricing on Humira, AbbVie’s top-selling immunosuppressive drug, and other brand drugs under language that Congress tucked into a $1.9 trillion COVID-19 relief bill that it passed in March last year.

The language will eliminate the cap on Medicaid drug rebates, now set at 100 percent of a drug’s average manufacturer price (AMP), on brand drugs only. Under the current Medicaid rebate calculation, if a drug’s price rises high enough relative to the inflation rate, the rebate owed can rise to AMP. Last year’s law would break the barrier and let the rebate owed exceed AMP. The change is expected to reduce federal Medicaid spending by $15.9 billion over 10 years.

A drug’s 340B ceiling price is AMP minus the Medicaid unit rebate amount. The same inflation penalty as under the Medicaid drug rebate program applies. To keep 340B prices from going negative, it has been the U.S. Health Resources and Services Administration’s (HRSA) policy for years to not let 340B prices fall below $0.01. HRSA formalized its 340B penny-pricing policy in a regulation that took effect in 2019.

Last year when Congress was still debating whether to lift the lid on the maximum Medicaid rebate amount, 340B manufacturer and covered entity stakeholders disagreed on what the effect would be on 340B pricing. Some on the manufacturer side said the 340B penny-pricing policy would continue to keep 340B prices from dipping below $0.01. Others representing covered entities said the penny-pricing policy would be unenforceable because it would be based on outdated law.

BioCentury’s issue brief notes that in 2019, AbbVie’s chairman and CEO testified before Congress that the inflationary rebate was 100% of AMP for eight of the company’s Humira NDCs from 2Q 2106 until at least 4Q 2018.

The Centers for Medicare & Medicaid Services (CMS) “does not make public a list of products that have reached the AMP limit,” BioCentury said. “Gonzalez’s testimony to Congress was a rare disclosure by a company and the reason Humira was chosen for this analysis.”

Modeling the 340B ceiling price of one Humira NDC that launched in 2003 at a wholesale acquisition cost of $1,088 “shows that the 340B ceiling price fell to zero on 2017 after years of WAC increases and inflationary penalties, and has been at zero ever since,” the issue brief said.

“Once the cap on the inflationary rebates is lifted, AbbVie and other manufacturers with products that fit the profile of Humira may have to pay 340B entities to distribute some of their drugs,” it said.

BioCentury points out that AbbVie last month imposed conditions on 340B pricing when hospitals use contract pharmacies. The restrictions apply to Humira and 23 other products for now. AbbVie said it “will inform covered entities when additional products are added and of other changes to the product list.”

UPDATE Thursday, Feb. 24, 2022, 8:00 a.m. EST—BioCentury has made its article free with site registration, you may access it at https://www.biocentury.com/article/641156/modeling-penny-pricing-under-340b.