SPONSORED CONTENT

As a pharmacist and executive pharmacy leader, I nodded in affirmation when reading McKinsey & Company describe pharmacy services as a critical source of value for health centers and hospital systems, and was not surprised that the firm also considers pharmacy to be an untapped opportunity for strategic growth.[1] But new research from Maxor shows that is changing as more leaders look to transform their pharmacy services from cost centers into revenue streams.

Survey snapshot: low pharmacy capture rates, missed revenue opportunities

Maxor commissioned Sage Growth Partners to independently recruit and survey 78 executives and pharmacy leaders at hospitals and health systems in Q2 of 2024. The chief medical officer of a health center shares a perspective that aptly echoes the state of hospital pharmacies today: “We look at pharmacy as a cost center and not a revenue stream.” Another research participant, the associate vice president of finance at an independent community hospital, says that the organization is not “maximizing opportunities” to generate new revenue and drive cost savings because like many health systems it continues to do “the same things we’ve always done. We haven’t changed as the environment changed.”

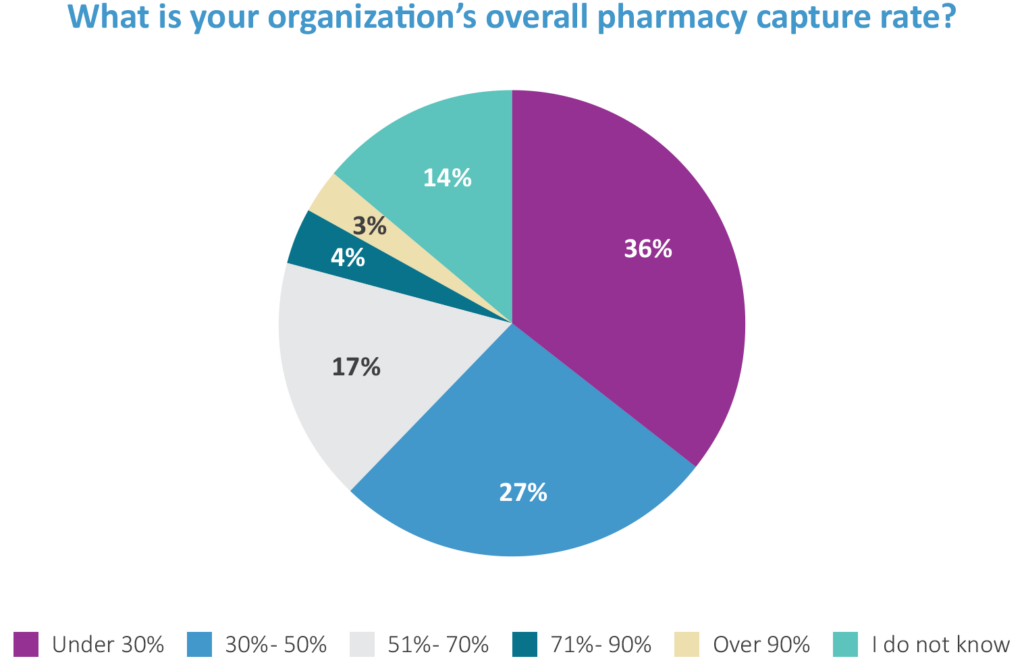

As a result, hospitals and health centers are leaving money on the table by not identifying and executing strategies to simultaneously drive new revenue and reduce expenses. Consider this revealing survey finding: 50% of respondents either don’t know their organization’s pharmacy capture rate or report that it is under 30%. From my perspective, that is a strong indication that these health centers, health systems and hospitals have plenty of room to improve pharmacy services and 340B programs, and organizations that fail to take action now will continue struggling with unsatisfactory capture rates for the foreseeable future.

Leaders are poised to partner on pharmacy services and 340B in the next 3-5 years

Nearly three-quarters (70%) of survey respondents say their hospital or health system plans to expand pharmacy services in the next three to five years. But only 29% of respondents are “very confident” their organization can meet the demand for pharmacy services.

Our survey findings, however, show the undeniable power of working with an external partner on pharmacy transformation. In fact, 72% of health systems that align with an external pharmacy services partner capitalize well on cost-savings and revenue generation, while only 32% operating pharmacy services without a partner capitalize well on cost-savings and revenue generation. Strategic partners help hospital and health system pharmacies maximize key value drivers, including: payer access and limited distribution drugs, pharmacy benefits management, and specialty pharmacy capabilities.

When it comes to 340B programs specifically: 76% of respondents say their health center is likely to engage a third-party partner for 340B within three years, and nearly 66% of those organizations are likely to align with a pharmacy solution-specific vendor. A partner well-versed in 340B, for example, can help develop a cross-functional pharmacy strategy across purchasing, formulary and prescribing, delivering clinical and financial value beyond just one program.

“I have worked with health centers that have had pharmacy partners for 340B purposes and I’ve seen the successes and the financial gains optimized from that partnership,” a survey respondent says.

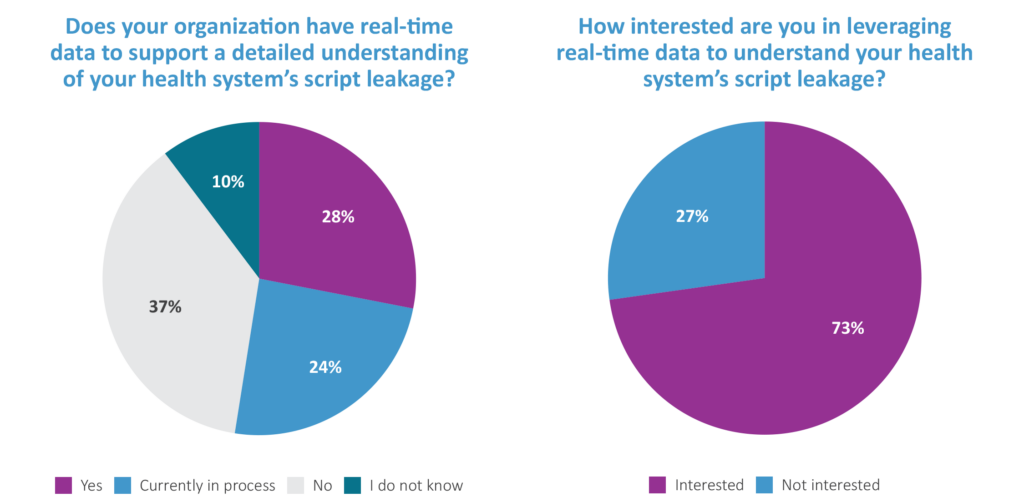

What covered entity pharmacy services need now: real-time data and analytics Despite the low rates of pharmacy capture, the survey results show that only about a quarter of hospitals, health centers and health systems are currently using real-time data and analytics to inform strategies that address script leakage, making it difficult to discern where leakage is occurring so it can be reduced or eliminated.

That is also changing. Our research shows that the majority (73%) of survey respondents are interested in leveraging real-time data to gain a clearer understanding of script leakage—signaling that more and more healthcare leaders are likely to partner for those capabilities in the short-term. When it comes to selecting a pharmacy services partner, the survey findings show that health system leaders have a strong preference for pharmacy-solution specific vendors for outpatient/retail and 340B programs, and they consider pharmacy-solutions specialists to be equally as strong as large vertically integrated players for inpatient, PBM, and specialty pharmacy.

“The right partner brings expertise in the areas we are lacking, as well as specialized experience and scale to drive profits to our facility by helping us capitalize on unrealized revenue through better processes,” according to survey respondents.

The biggest risk? Not taking action to transform pharmacy services

With the ongoing workforce crisis, rising drug and pharmacy costs, health system, health center and hospital leaders simply cannot afford to continue operating pharmacy as a cost center when it should instead be generating revenue. The risks of inaction are clear: loss of prescription volumes, poor clinical outcomes, suboptimal management of pharmacy frameworks, increased risk of drug-on-drug interactions, increased readmissions, and channel competition with national vendors.

Our research illustrates the power of partnering to develop integrated pharmacy strategies supported by an ecosystem of care by keeping both patients and employees within your network while appropriately optimizing 340B and specialty pharmacy opportunities. The Maxor market research report, Hospital leaders are transforming pharmacy services from cost centers to revenue streams: opportunities & obstacles, helps to showcase how an independent partner focused on holistic pharmacy helps with more controlled inventory and medication management which leads to better adherence rates and clinical outcomes. Read More Here.

Sources:

1. Untapped opportunities for hospital pharmacies, McKinsey & Company

Joel Wright is President of Pharmacy Services at Maxor. He can be reached at jlwright@maxor.com.