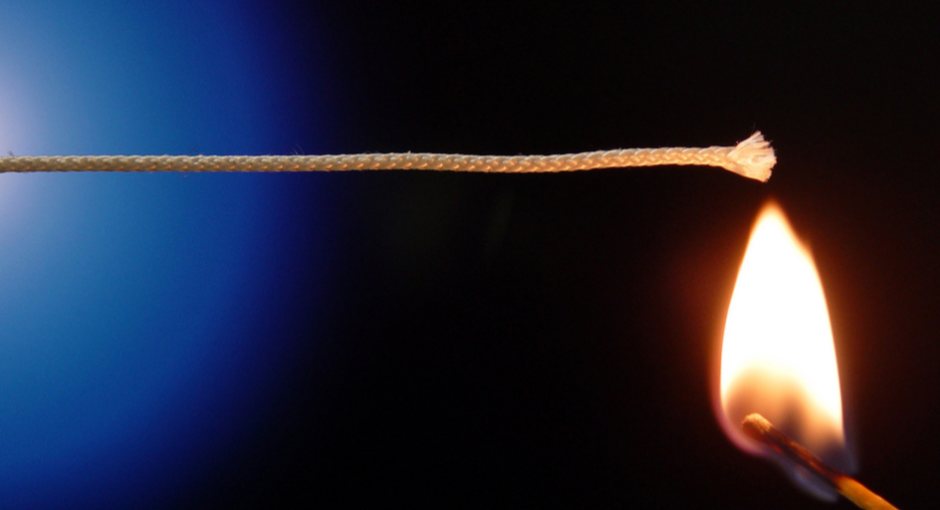

Today is the anniversary of Eli Lilly lighting the fuse on the 340B program’s most explosive year ever.

On May 18, 2020, Lilly sent the U.S. Health Resources and Services Administration (HRSA) a letter saying that, unless it heard otherwise by June 30, it would assume it had HRSA’s blessing to stop offering 340B pricing on Cialis dispensed by covered entities’ contract pharmacies, starting July 1. If an entity didn’t have in-house pharmacy, Lilly said the entity could designate just one contract pharmacy for Cialis shipments.

Lilly expanded the policy to the rest of its drugs on Sept. 1. The U.S. Health and Human Services Department’s (HHS) top lawyer told the company HRSA had significant concerns about what it was doing, was preoccupied fighting COVID-19, and had yet to make a final determination about the legality of Lilly’s actions. Don’t mistake that “as somehow endorsing Lilly’s policy,” he warned.

Five other drug manufacturers—AstraZeneca, Sanofi, Novartis, Novo Nordisk, and United Therapeutics—then either copied Lilly’s policy, or said entities could get 340B pricing at contract pharmacies only if they handed over their contract pharmacy claims data, so it could be checked for duplicate discounts.

On Dec. 10, HHS published rules setting up a system for covered entities to use to resolve 340B pricing disputes with manufacturers. The system is expected soon to start hearing 340B overcharging claims that were filed against manufacturers in January.

Then, on Dec. 30, HHS said drug makers could charge entities no more than the 340B ceiling price when contract pharmacies acted as entities’ agents. But it did so in an advisory opinion that lacked the force or effect of law. A blizzard of lawsuits came next.

In a major development yesterday, a day shy of a year after it all began, HRSA announced its final decisions about the six manufacturers’ 340B contract pharmacy actions.

A Closer Look at HRSA’s Letters

In six nearly identical letters to AstraZeneca, Eli Lilly, Novartis, Novo Nordisk, Sanofi, and United Therapeutics yesterday morning, HRSA Acting Administrator Diana Espinosa told the companies that their restrictions on 340B program pricing have resulted in overcharges and are in direct violation of the 340B statute. She told them they must immediately begin offering their covered outpatient drugs at the 340B ceiling price to covered entities through the entities’ contract pharmacy arrangements, and must credit or refund all covered entities for overcharges that have resulted from the companies’ 340B contract pharmacy policies. Failure to comply could lead to imposition of civil monetary penalties (CMPs), she said. The civil fines would be the first ever against manufacturers in 340B program history.

Espinosa gave the manufacturers until June 1 to disclose their plans “to restart selling, without restriction, covered outpatient drugs at the 340B price to covered entities that dispense medications through contract pharmacy arrangements.”

We reached out to the six manufacturers yesterday afternoon, and heard back from Lilly, AstraZeneca, Sanofi, and Novo Nordisk. They are the four suing in federal court to stop HHS from enforcing its Dec. 30 advisory opinion. Lilly and Sanofi also are suing to block HHS’s 340B administrative dispute resolution (ADR) final rule. A federal judge in March temporarily blocked HHS from enforcing the rule against Lilly.

It is unclear how Espinosa’s letters will affect 340B ADR claims filed against Lilly, AstraZeneca, and Sanofi. The judges hearing Lilly, AstraZeneca, Sanofi, and Novo Nordisk’s lawsuits against HHS could ask to be briefed by both sides about how HRSA’s letters affect the cases.

Carrot and Stick Approach

None of the four manufacturers that gave us statements said how they would respond to HRSA’s cease and desist letters. All however defended the legality of what they have been doing and it would be no surprise to see the companies ask the courts to block the government’s action. Interestingly, HRSA offered a carrot to the companies that agree to cooperate with the government and restore 340B discounts and provide credits and refunds. HHS told the six manufacturers that it will determine whether CMPs are warranted based on their willingness to comply with its obligations under 340B statute. Considering that the government has the ability to assess fines of $5,000 for each instance of overcharging, the financial liabilities could pile up and this could be a factor in determining the companies’ next steps.

HRSA’s Reasoning

In its letters to the six manufacturers, HRSA said the 340B statute’s requirement that manufacturers shall offer covered outpatient drugs to covered entities at or below 340B ceiling price, if they make such drugs available to any other purchaser at any price, “is not qualified, restricted, or dependent on how the covered entity chooses to distribute the covered outpatient drugs.”

“Nothing in the 340B statute grants a manufacturer the right to place conditions on its fulfillment of its statutory obligation to offer 340B pricing on covered outpatient drugs purchased by covered entities,” the letters say. The 340B law also requires manufacturers that have signed a 340B pharmaceutical pricing agreement to comply with these requirements, HRSA said.

HRSA said that, under its 2017 340B ceiling price and manufacturer civil monetary penalties final rule, “manufacturers are expected to provide the same opportunity for 340B covered entities and non-340B purchasers to purchase covered outpatient drugs. This extends to the manner in which 340B drugs are made available to covered entities (e.g., access to 340B ceiling prices through wholesalers that make products available at non-340B ceiling prices).”

HRSA said its 340B ceiling price and CMP rule “further specifies that a manufacturer’s failure to provide 340B ceiling prices through the manufacturer’s distribution agreements with wholesalers may violate a manufacturer’s obligation under the 340B statute. HRSA has made plain, consistently since the issuance of its 1996 contract pharmacy guidance, that the 340B statute requires manufacturers to honor such purchases regardless of the dispensing mechanism.”

HRSA rejected the manufacturers’ arguments that their actions are necessary to prevent diversion and duplicate discounts.

“The 340B statute provides a mechanism by which a manufacturer can address these concerns,” HRSA said. “Specifically, the manufacturer must (1) conduct an audit and (2) submit a claim through the Administrative Dispute Resolution process….The 340B statute does not permit a manufacturer to impose industry-wide, universal restrictions.”

HRSA told each manufacturer it “must immediately begin offering its covered outpatient drugs at the 340B ceiling price to covered entities through their contract pharmacy arrangements, regardless of whether they purchase through an in-house pharmacy.” It said each manufacturer “must comply with its 340B statutory obligations and the 340B Program’s [civil monetary penalties] final rule and credit or refund all covered entities for overcharges that have resulted from [the manufacturer’s] policy. [Each manufacturer] must work with all of its distribution/wholesale partners to ensure all impacted covered entities are contacted and efforts are made to pursue mutually agreed upon refund arrangements.”

HRSA said “continued failure to provide the 340B price to covered entities utilizing contract pharmacies, and the resultant charges to covered entities of more than the 340B ceiling price, may result in” imposition of civil monetary penalties. In a footnote, it said the inflation-adjusted 2020 penalty for each instance of knowing and intentional overcharging is $5,883. HRSA said HHS will decide whether civil fines are warranted based on each manufacturer’s “willingness to comply with its obligations” under the 340B statute.

HRSA asked each manufacturer to “provide an update on its plan to restart selling, without restriction, covered outpatient drugs at the 340B price to covered entities that dispense medications through contract pharmacy arrangements by June 1, 2021.”