SPONSORED CONTENT

When a covered entity enrolls in the 340B program it must inform the Health Resources and Services Administration (HRSA) whether it will “carve in” and acquire 340B drugs for its Medicaid fee-for-service (FFS) eligible patients, or “carve out” and purchase drugs for its FFS patients outside the 340B program.

A covered entity choosing to carve in Medicaid FFS claims must provide the HRSA Office of Pharmacy Affairs (OPA) with the Medicaid Provider Number(s) (MPNs) or National Provider Identifier(s) (NPIs) it uses to bill FFS Medicaid (in any state) for 340B drugs. This information will appear on the 340B Medicaid Exclusion File (MEF), notifying states and manufacturers that drugs purchased under that MPN or NPI are not eligible for a Medicaid rebate. Covered entities are required to ensure that the information listed on the MEF is accurate.

Published quarterly on the OPA Information System (OPAIS), the MEF is the data source HRSA uses to assist in preventing duplicate discounts at the provider level. Duplicate discounts occur when manufacturers sell drugs at a discount under the 340B program and later pay Medicaid rebates on the same drugs. While the MEF still serves that function today, many states have also started using claims-level methods (a.k.a., modifiers) to identify 340B drugs dispensed or administered to Medicaid FFS eligible patients.

Actions to take when carving in or out of the 340B drug program

When submitting information to the MEF, covered entities carving FFS Medicaid claims into the 340B program should include an MPN or NPI, or both, and answer “yes” to the following question: “At this site, will the CE bill Medicaid FFS for 340B drugs?”

Covered entities not purchasing drugs under the 340B program for its FFS Medicaid eligible patients should answer “no” to the question — “At this site, will the CE bill Medicaid FFS for 340B drugs? “—and not include NPIs or MPNs on the MEF.

For alternate scenarios, refer to the following Apexus FAQs1:

Q: We do not bill Medicaid FFS at all. We do, however, use 340B for these patients; does HRSA expect us to answer “yes” to its Medicaid billing question?

A: In this situation, the entity should answer “no” to the Medicaid billing question, “At this site, will the covered entity bill Medicaid fee-for-service for drugs purchased at 340B prices?”

Q: We bill at an all-inclusive rate for Medicaid, no NDC is transmitted to Medicaid, and therefore no duplicate discount will occur. We do use 340B for these patients; does HRSA expect us to answer “yes” to its Medicaid question?

A: Covered entities that bill Medicaid fee-for-service for drugs purchased at 340B prices must answer “yes” to the Medicaid billing question, regardless of the rate at which they are reimbursed under Medicaid.

Be aware of common pitfalls associated with the MEF

Covered entities should be aware of the common pitfalls they may encounter with the MEF.

Common issues include:

- The covered entity forgets to list all states where they are billing Medicaid FFS for 340B drugs.

- The covered entity lists the NPI in the place where the MPN should be listed.

- The covered entity transposes numbers.

- The covered entity does not include all NPIs.

- The covered entity is not billing FFS Medicaid but fails to answer “no” when asked this question on the MEF.

Tips for avoiding these common pitfalls

Apexus has a tool called the Medicaid Exclusion File Checklist, which lists common errors in the MEF. In addition, Apexus has self-audit tools entities can use to prevent duplicate discounts. Covered entities should consider using the Apexus toolset to perform regular reviews of their practices.

Recommended activities include:

- Regularly review your policies and procedures to ensure they reflect correct practices for handling Medicaid FFS claims or when you make changes to your practices.

- Perform a monthly VLOOKUP on 100% of 340B-approved claims payer information by taking the list of state-pertinent Medicaid FFS Bank Identification Number (BIN), Processor Control Number (PCN), and group numbers that are being carved out in your 340B TPA contract primary software and ensuring none of these plans are in the approved claims data for either the primary or secondary payer.

- Perform quarterly reviews to ensure what you are doing in practice is reflected clearly on the MEF.

- If carving in clinic-administered drugs, ensure you’re following your state policies on billing requirements. Select a sample of UB04 or HCFA 1500s to ensure claims are being billed correctly and that all NPI/Medicaid billing numbers are accurate. Also, perform a monthly check to ensure you’re billing the correct amount.

- If carving in Medicaid FFS claims in your owned pharmacy, perform checks regularly to ensure you’re following state policies.

- Visit Apexus FAQs on preventing duplicate discounts for further clarification as needed.

- Contact your state Medicaid agency to clarify policies and procedures related to 340B. Make sure you frequently check in to see if there are any changes.

- Review changes in state plan amendments.

1 https://www.340bpvp.com/hrsa-faqs/medicaid/duplicate-discounts

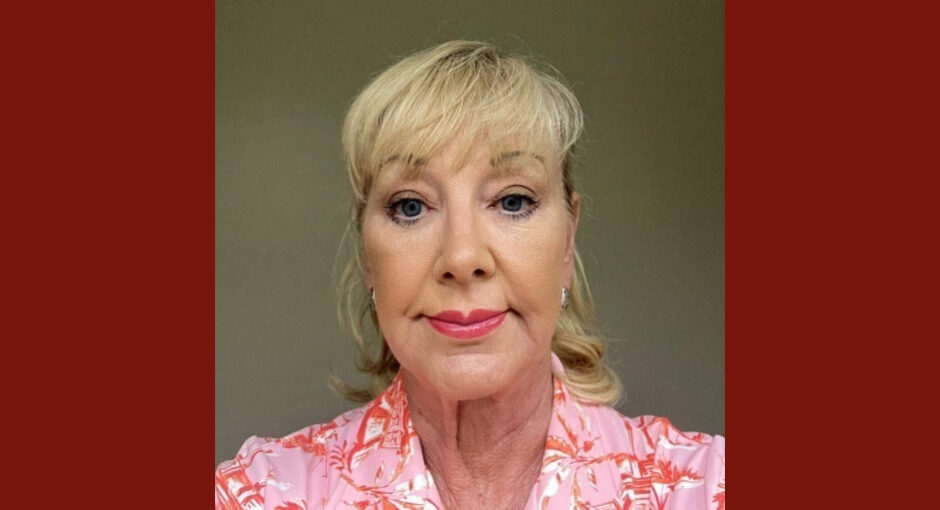

Holly Russo is Senior 340B Director for Maxor. She can be reached at herusso@maxor.com.