SPONSORED CONTENT

Today’s U.S. health systems face significant financial challenges. Many are still trying to recoup pandemic-related losses stemming from forced shutdowns, elective procedure postponements, and reduced outpatient visits. These factors have contributed to billions in lost revenue, leaving many of America’s health systems with negative operating margins.

As a result, health systems are desperate to find new ways to maximize cost savings and generate new revenue. Enhancing specialty pharmacy operations is increasingly being recognized as a primary way to achieve this objective in the short term. A new infographic outlines how therapy expansion, increased specialty drug spending, access challenges, and growing patient need are currently converging to create a unique opportunity for health systems to realize sizable financial gains by evolving their approach to specialty pharmacy.

Manufacturer restrictions create barriers to 340B discounts

Hospital or health system covered entities (CEs) eligible for drug discounts through 340B potentially have the most to gain from this opportunity. It has become increasingly more difficult for these healthcare providers to capture 340B discounts due to the restrictions many drug manufacturers have placed on the use of contract pharmacies under the program – restrictions that have been recently upheld by the Third Circuit Court of U.S. Appeals. The limitations themselves are exhausting to navigate, differing from manufacturer to manufacturer and seemingly changing by the day. Capturing 340B discounts in this environment is like trying to hit a moving target.

Manufacturer restrictions also stack the odds against health systems, limiting the number of pharmacies a CE can contract with for 340B pricing and/or the distance between the CE and the contract pharmacy(ies). A 40-mile radius may seem like a reasonable geographic service area on paper. It often is when referring to retail pharmacies. Specialty pharmacies, however, are a different story.

Given their complex policies and procedures and strict accreditation requirements, there are far fewer specialty pharmacies than retail pharmacies across the country. The high-cost specialty medications these locations provide are some of the most heavily discounted under the 340B program and deliver some of the most life-altering benefits to patients. However, the scarcity of these facilities can often make it difficult for a health system to find specialty pharmacy partners within a 40-mile radius, and drug manufacturer restrictions don’t differentiate between specialty and retail pharmacies.

A balanced approach to specialty pharmacy can break down barriers, optimize financial outcomes

These barriers make it more difficult for health systems to capture 340B discounts via a contract-pharmacy-only approach. Now is the time for health systems to start looking at their pharmacy operations more holistically and consider adding an entity-owned specialty pharmacy to complement existing contract pharmacy relationships. This move will ensure a balanced program that is well positioned to optimize medication access and savings, extending the best possible service and affordability to patients while introducing a new revenue stream for the health system.

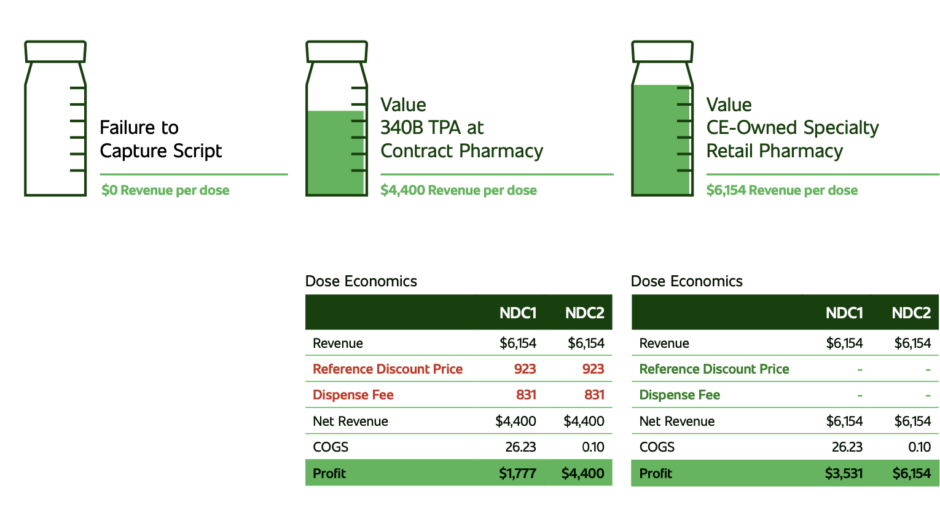

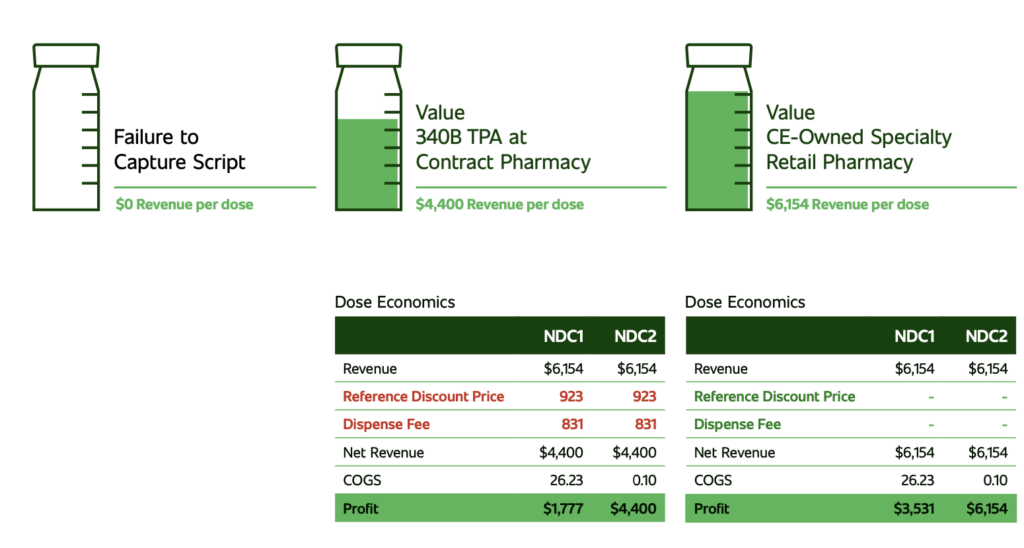

An entity-owned specialty pharmacy not only enables a health system to increase capture rate by keeping more prescriptions in-network, but it also maximizes revenue gained from specialty drugs by eliminating inflated contract pharmacy reference prices and dispensing fees. The graphic below illustrates the revenue per dose that can be generated by a specialty contract pharmacy and an entity-owned specialty pharmacy for a leading rheumatoid arthritis medication.

Contract pharmacies are (and will remain) an integral part of the health system pharmacy ecosystem. A health system simply won’t be able to capture certain prescriptions through an entity-owned pharmacy (e.g., orphan drugs, limited distribution drugs, certain cell and gene therapies, etc.) However, supplementing these existing partnerships with an entity-owned specialty pharmacy can enable health systems to sidestep many of the manufacturer-imposed 340B discount restrictions while optimizing overall capture, savings, and revenue. At a time when 340B providers face unprecedented financial challenges, operating a high performing specialty pharmacy will enable you to continue 340B’s purpose of stretching scare resources and expanding access to care. Particularly for our most vulnerable patient populations.

Health systems are increasingly realizing the value of adding an entity-owned specialty pharmacy. According to ASHP, more than 26% of hospitals owned a specialty pharmacy in 2019, compared with less than 8% in 2015. These numbers continue to grow as more health system leaders indicate plans to add a specialty pharmacy to their operations in the short term. Moreover, while 90% of hospital systems with over 600 beds already own a specialty pharmacy, there is ample opportunity for these providers to expand and optimize their programs by adding integrative disease states.

It’s becoming increasingly important for health systems to enhance their specialty pharmacy offering, not only to optimize 340B savings and generate much needed new revenue, but also to keep pace with competing health providers that do own a specialty pharmacy. Providing these services in-network streamlines access and workflow, providing a more seamless and convenient experience for patients. This effort may seem daunting, but expert partners can help interested health systems navigate the current 340B landscape and support a quick successful launch of an entity-owned specialty pharmacy.

Kristen Dowd is Director, Product Marketing – Specialty Pharmacy Services at Omnicell. She can be reached at kristen.dowd@omnicell.com